The New Bull Market?

As I type this, the major U.S. stock market indices, even if they are not perfect indicators like I alluded to above, are at all-time highs. While all of the headlines are negative, the market has been able to power to new highs; this is typically a bullish sign. Most bull markets top out after everyone is complacent and has bought into the idea of stocks going up to the moon – this is hardly the case right now. In a related note, the Dow Jones Industrial Average closed at a new high all five days of last week. This is the first time this has occurred in almost 20 years. MORE: Stock Market's New High -- A Record About Nothing

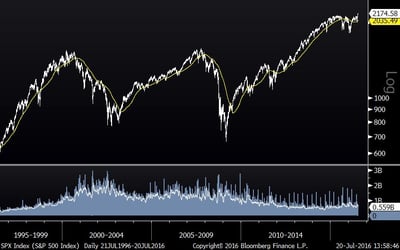

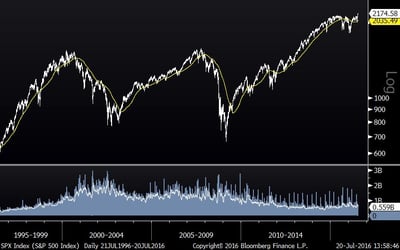

S&P 500 (20 Years)

Pokemon Go

My town has been overcome by teenagers and 20-somethings walking around aimlessly with their phones in hand at all hours of the day and night Click to Watch Video, just like the characters in Walking Dead. Apparently, we are a hotspot for catching Pokemon characters with Pokeballs and we even have a couple of Pokemon gyms. For anyone over the age of forty or so, this phenomenon is bewildering. Pokemon Go, in only two weeks, has become the most downloaded mobile game ever and already has over 20 million US users. What amazes me the most is that unlike other electronic games, it has mobilized millions of young people who would otherwise be sitting on their couches at home. For the older generation, being mobilized by walking around like a zombie with a phone in hand is much less pure than going out and catching lightning bugs, but it is 2016, after all. I have seen people turn it into a family event with mothers and fathers looking for Pokemon with their kids, so it cannot be that bad, right?

From an investment-related standpoint, Pokemon GO has spiked the shares of Nintendo stock by 100%. While this may be a fad, what intrigues me is that this could be the beginning of a whole new era of “augmented reality” technology as they are calling it. Imagine the value of getting all of these people out on the streets and exposed to your brand or driving traffic into your shop or restaurant. This new age technology could ironically be a game-changer for the “shop local” cause. It is also good from a health standpoint – I heard a joke the other day that Pokemon Go has done more for childhood obesity in two weeks than any other effort has done in a decade. MORE: How Apple Could Generate $3 Billion from Pokemon Go

Index Construction

Most indices are constructed on a market capitalization weighted basis. While many investors and investment managers compare their portfolios to the S&P 500 or some other index as a benchmark, many do not realize that the weightings within these indexes are very different than how most portfolios are constructed. For example, if one decided to invest in 25-30 S&P 500 companies, they would probably invest in 2-4% in each holding. If, however, he/she invested the same way the S&P 500 is constructed, they would invest 30 times as much in a company like Apple than they would in a company like Under Armour. Most portfolio theorists would say that this does not make sense. To illustrate the effect of weighting by market capitalization, the chart below shows the S&P 500 and the S&P 100, which is the largest 100 companies in the S&P 500. As you can see, they look almost exactly alike suggesting that 80% of the companies in the S&P 500 index have little effect on the index. This, of course, begs the question whether market capitalization weighted indexes are really a proper benchmark for measuring stock portfolios. MORE: Three Problems with the S&P 500 Index