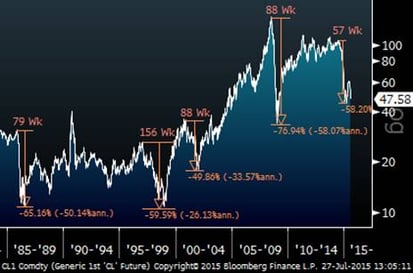

Texas Tea

As you surely are aware, oil and the associated energy stocks have dropped precipitously over the past year. Although the dynamics and inputs have been different each time, it is interesting to consider the recent decline relative to past periods of extreme weakness. Looking at similar periods over the past thirty years, the magnitude of the recent drop is “in the neighborhood” of the other declines. You will notice, however, that from a duration standpoint, all of the other declines lasted longer from peak to trough, suggesting that the current rout may not be over and could hit new lows in the coming months.

Oil Price Routs over 30 Years

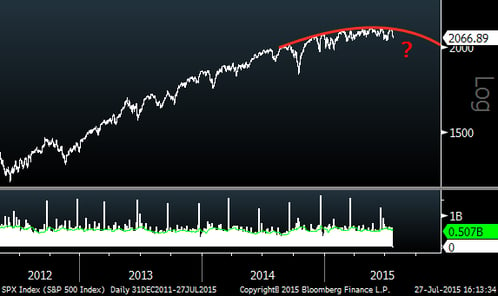

Recent Market Action

The market was down again today and is back to roughly even on the year. What strikes me as being different about the most recent action is that for the first time in several years, the market has refused to go to new highs after weakness. As you can see in the chart below, after every other short-term downturn, the market reversed and went to new highs. After the last two (relatively small) downturns, however, the market failed to hit new highs and then weakened again. It is too early to say we are in a new downtrend, but it is worth noting the change in investor appetite. In the short-term at least, the pressure is downward and investors/traders have been unwilling to pay higher prices for stocks. Is this just a consolidation before the market powers to new highs, or is this the beginning of a broader downturn?

S&P 500 (Three Years)

As you may know, I was in Cape Cod last week visiting my family. It is nice to be “back in the saddle.” Today’s blog is short, but I thought it would be timely to bring up these two timely subjects…stay tuned!