Sell-Side Analysts

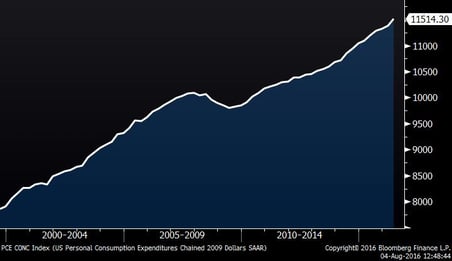

I have long been skeptical of sell-side analyst recommendations for a number of reasons. I thought it would be interesting to share the chart below, published earlier this week by Strategas. As you can see, year-to-date, investors would have been much better off actually buying the stocks that analysts hate and selling those that they love. Read more about how sell-side analyst projections are worse than some very simple measures: Bloomberg: Maybe It's Worth Underestimating Analysts

U.S. Consumer

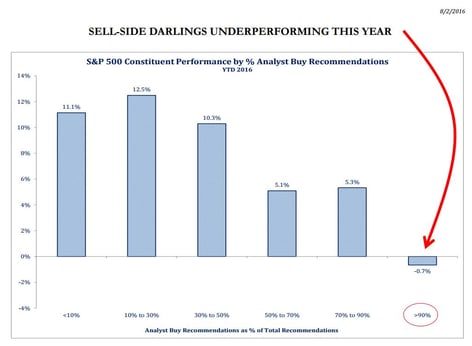

The chart below shows U.S. Personal Consumption on an inflation-adjusted basis. As you can see, the U.S. consumer remains quite strong, and over time has proven to be very resilient except during the worst of times. There is always debate about whether the consumer is weakening, usually based on weakness or strength in certain consumer related industries or companies, but as a whole, U.S. consumers are spending. There have, however, been some behavioral shifts that effect certain sectors such as the shift from brick and mortar purchases to online purchases or the shift toward spending on experiences instead of “stuff”. Recently, some have observed the restaurant stocks are weak, and that that usually precedes economic weakness. Is that actually the case, or are consumers moving away from eating at chain restaurants (that are likely to be publically traded) and toward more independent and local restaurants? In Cleveland, that certainly seems to be the case. Related: 11 Hottest Restaurant Dining Trends

Real U.S. Personal Consumption

New Home Sales

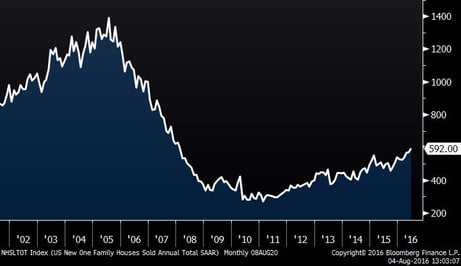

As the chart below illuminates, new single family home sales have been slower to recover than some other areas of the economy. This may be partially due to the trend toward renting and the continued decline in the rate of home ownership. From a local perspective, I live in a place where there is not much new land available to build new homes, but when land does become available, it is like SimCity where foundations sprout out of the ground seemingly overnight.

New Single-Family Home Sales (15 years)

Investor decision-making

The image below reminds me of how many people seem to make investment related decisions. I thought maybe some of you would get a chuckle out of this: