Netflix (NFLX) since 2012

Pimco Total Return Fund

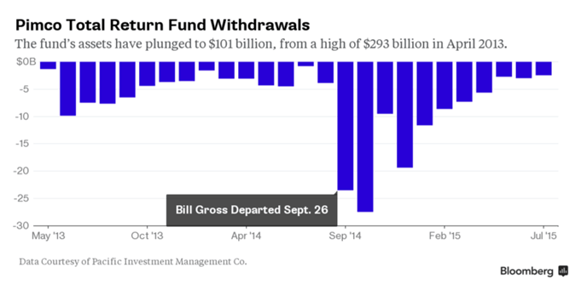

The Pimco Total Return Fund was once the largest mutual fund in the world. Since its peak in April 2013, the fund has seen net withdrawals for 27 straight months straight, reducing the fund to a third of its former size. Interestingly, the largest bond fund in the world is now a passive, index-based Vanguard bond fund.

MLPs and Oil

Master Limited Partnerships (MLPs) have been quite weak in the past year. There has been some discussion related to whether these stocks are more affected by oil prices or interest rates. While the argument can be made that higher rate expectations would be a headwind for these high-yield stocks, there is no doubt that looking back, oil prices are the main driver of these stocks. The chart below shows a popular MLP ETF versus oil prices. On the top of the chart below, one can see that they move roughly in tandem; the bottom shows the positive correlation between the two.