Consumer Debt Defaults

Earlier this week, Synchrony Financial, a private-label credit card issuer, announced that it was increasing its guidance for charge-offs. While the overall level of charge-offs is relatively low, this is one of the first tangible signs that the consumer might be weakening and that credit may be deteriorating after years of improvement following the 2008-2009 financial crisis. Synchrony is the largest creditor for retail-store credit, so they are viewed as a bellwether for the industry as a whole. There have been lots of fears circulating related to auto loans, credit cards and student loan debt, so this is something to pay attention to. Heretofore, the U.S. consumer has been resilient. Is this just a minor tick up or the beginning of trend reversal? MORE: Cracks Show in Consumer Credit -- WSJ

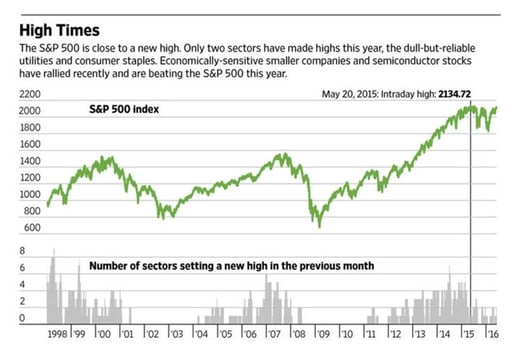

Stealth Bear Market

While the S&P 500 is close to new highs, suggesting a strong and healthy bull market, looking within market sectors reflects something very different. Usually, in a true bull market, most sectors and stocks move together and “all boats rise with the tide”. In this case, many sectors have actually been in a bear market, so just being invested in the “bull market” has not been enough; investing in the right places has been critical. This bifurcated market has resulted in a higher than normal level of dispersion between indices and investment manager performance. I know I have talked about this a lot, but the chart below shows this phenomenon in a different way. The bottom bar chart shows the number of sectors that have recently hit new highs. As you can see, for the last year, that number has been fluctuating between zero and two. Those two are utilities and consumer staples. In a bull market at or near its highs, very few people would predict that the best performing sectors have been utilities and staples. MORE: Is The Bull Market Ending...Or Just Beginning?

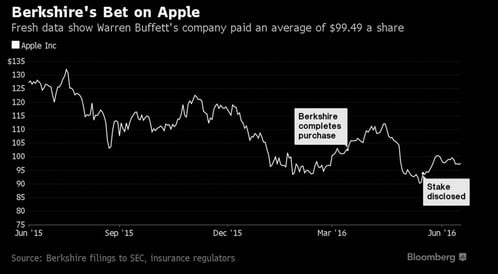

Apple

Apple is one of the most widely held stocks in indices and investor accounts. There are two camps on this stock. One camp says that the company is merely a product company, their days of innovation are behind them and that they are the next Blackberry. The other camp says that the current valuation is extremely attractive and that Apple has a history of innovation and will continue to do so…or they will use all their cash to acquire more innovative and faster growing companies. Warren Buffett appears to be in the latter camp: