Today’s big market news was that China decided to abruptly devalue their currency with the biggest move in over twenty years. In recent years, China has been trying to move toward a model of growth via consumption and away from a reliance on external investment. Part of this has been the move toward a more free-market currency policy. Moving toward this new economy takes a long time, and given recent economic weakness in China, they decided to take a step back and devalue their currency to help strengthen their economy. This decision rippled through the financial markets, contributing to a one percent loss in the U.S. stock market. Many well-known stocks with Chinese or commodity exposure were down significantly more than the overall market. On paper, this currency move should be good for safe-haven and defensive assets, and bad for commodity prices and stocks with Chinese exposure. At the simplest level, it makes goods and services originating in China cheaper and makes things made elsewhere more expensive for people in China.

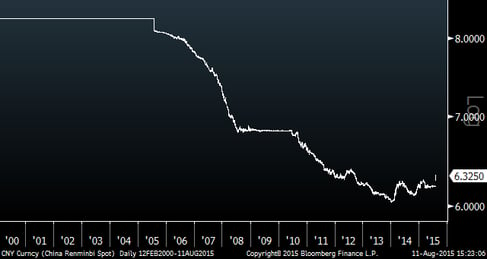

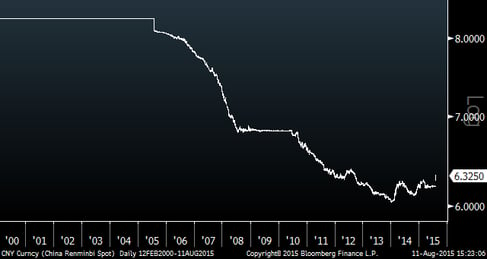

The two-year chart below shows the meaningful magnitude of this move. However, when looking at the move in a longer-term perspective, this move is not alarming. Whether this is the beginning of a broader policy or a one-time adjustment remains to be seen.

lar versus Chinese Yuan (Two Years)

US Dollar versus Chinese Yuan (15 Years)

Dow Weakness

For the past several years, with a hiccup here and there, the market has been in a strong uptrend. Recently, many indices including the Dow Jones Industrial Average have been exhibiting a little more weakness than in the past few years and an inability to continue to new highs. While this is still short-term and not necessarily the beginning of a new downtrend, it is worth paying attention to and at least considering the possibility of market consolidation or weakness. The market has been up for six-plus years and by most accounts, valuations are high. With this in mind, it would not be unusual or unhealthy to see the appetite for stocks moderate for a period of time.

Dow Jones Industrial Average (2.5 years)

Homebuilding

On the other hand, many sectors and industries are still showing strength. One example (below) is homebuilding related stocks. As you can see, these stocks are at new highs and continue their uptrends of the last few years. Like the Dow stocks and others, these temporarily broke the trend in late 2014.