Brexit Stage Left

In the last blog, I asked whether this would mark the beginning of a major downturn or just be a blip. Just like many other emotional moments, very few investors would have guessed that it would be a blip. So far, at least as far as the U.S. market is concerned, it has been a blip. In fact, as I type this, the S&P 500 is at an all-time high. As the market crosses new highs, there is broad participation among sectors, sentiment is hardly exuberant and all the headlines are negative – historically, these are bullish signals. MORE: S&P 500 Heads for Record High

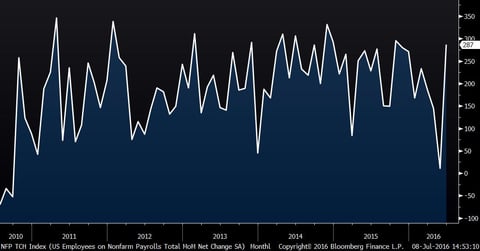

S&P 500 (Three Years)

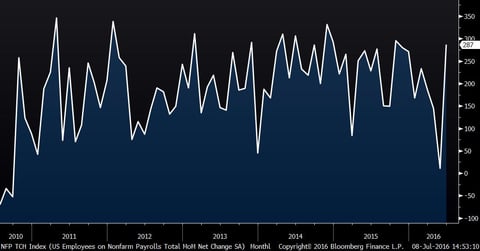

Non-farm Payrolls

A month ago, the non-farm payroll data came in somewhat short of expectations, exacerbating recession fears. Today, the data was released from June and showed a sharp reversal from May, alleviating some of the recession fears. MORE: U.S. Created more than 287K Jobs in June

Non-Farm Payrolls(Six Years)

Interest Rates

Rates on the 10-year treasuries are at new lows. With the Brexit, most people believe rates will be lower for longer. Economics 102 tells us that lower fixed income rates should mean stronger appetite for alternatives to that yield. Dividend-paying stocks have certainly benefitted and continue to benefit.