Quote of the Week

“He who is not courageous enough to take risks will accomplish nothing in life.” – Muhammad AliBonds Versus Stocks

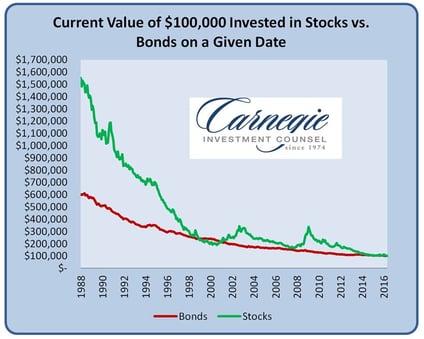

A widely held belief among investors is that over time, equities will do better than bonds. While I believed this to be true, I thought it would be interesting to test this. I was particularly interested in what happened if someone were unlucky enough to have invested all of their money in stocks near the peaks prior to the two major bear markets experienced in the past 30 years. The chart below shows the current value of $100,000 invested in stocks and bonds on a given date in the past. To clarify, if one had invested $100,000 in stocks in 1988, he/she would currently have around $1,600,000. Investing the same amount in bonds would have resulted in a current value of $600,000.

Looking back over the past thirty years, there is only one short period of time where buying bonds and leaving it there until today would have been better than stocks – the bull market peak before the 2000-2002 bear market. Even in this case, bond out performance has been marginal. Interestingly, even if one had invested in stocks at the peak of 2008, right before the biggest bear market since the Great Depression, they would still have been better served being in stocks. MORE: Why Stocks Outperform Bonds

Non-Farm Payrolls

Earlier this week, the May non-farm payrolls data was released. Although the market did not react strongly, the number was somewhat worse than expected. Going into and during past recessions, this reading has plummeted. That said, there have been many “head fakes” over the years as well. If we are not going into a recession, I would expect this number to bounce back. Numbers below zero, which the last reading was close to, are typically associated with recessions. Stay tuned… MORE: Odds of Recession has Hit a High -- JPM

Non-Farm Payrolls (25 Years)

Investor Sentiment

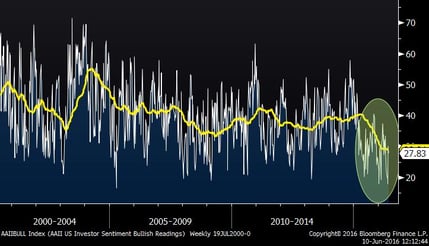

The chart below shows the percentage of bullish investors as surveyed by the AAII. As you can see, the number of bullish investors has been quite low over the past year. This indicator usually exhibits quite a bit of variance as investors become excited or depressed about market conditions. Usually, market peaks occur when excitement is at its highest, and vice versa. This time around, as the market approaches new highs, investor excitement has remained somewhat muted; in fact, it recently hit the lowest level in over a decade. Typically this would be a bullish signal, suggesting that new highs may be ahead. We’ll see…

AAII Investor Sentiment – Bullish Readings