Inflation is on the minds of many and there is no shortage of price increase anecdotes around the country. From commodities like iron ore and copper doubling in price, to paying MSRP for a year-old car, these observations of rising prices are coloring perceptions about general affordability, the dollar, the central bank and investments.

Whether we are experiencing inflation is not up for debate, however, the prospect of sustainable inflation is definitely debatable. Is it the ‘80s all over again? Can we objectively look at the pandemic-induced supply disruptions, a confluence of weather anomalies, lean manufacturing driven supply chain decisions and a Texas freeze, and call it a structural and sustainable inflation? Not really. At least, not yet.

Reading the Inflation Signs

April inflation readings came in at a robust 4.2%, including the impact of crude oil going from $25 a barrel on average to $60. Core inflation read 0.9%, an eye-popping number still but it is worth a closer look. Used cars and reopening categories such as airfare, prepped food, hotels, and so on, generally account for 13% of the inflation basket. In April, those accounted for more than half of the 0.9%, while these very categories were deflationary last April.

If you have priced a used vehicle with more than 10,000 miles at MSRP, you have car rental companies to thank. Here’s what happened. These companies liquidated cars last year in anticipation of a longer recession and are rebuilding their fleet from the used car market.

The strength of the reopening recovery should not have been that surprising given the loose monetary and fiscal regime, yet it is now creating the urgency for inventory replenishment at a faster clip than at any point in recent memory.

Lumber Prices Skyrocket

One cannot write on inflation without at least a passing reference to lumber. It has been reported that mountain pine beetles, no bigger than a grain of rice, have destroyed 15 years of log supplies, enough for nine years’ worth of single-family homes at current construction levels. That was just before the pandemic.

Making matters worse, a new sawmill takes more than two years to become operational if labor is available. Throw in a trifecta of locked-down bored homeowners adding decks and playhouses, construction bouncing back to keep up with first time home buyer demands and 30-year mortgages under 3% APR, and you have demand outstripping supply in an already constrained logging industry.

The Big Freeze and Pricy Grains

Then, there was Texas; the Texas freeze to be more specific. The state, along with the Gulf Coast, is responsible for producing 80% of the polymers for the injection molding industry. Resin manufacturing facilities undergo a specific process before a shutdown and that process did not occur during the freeze. In fact, the abrupt shutdown damaged not only the polymer machinery, but it also damaged the machines needed for raw materials processing as well. The replacement units are on back order as exports are being curbed to address homegrown demand first, but it will likely be a few more months before the backlog is cleared. With a Mexico-based resin facility’s opening delayed due to administrative issues, almost every plastics-based product is experiencing double-digit inflation in its supply chain.

Meanwhile, bad weather in Brazil, a large agriculture exporter, has added to the price bump in grains.

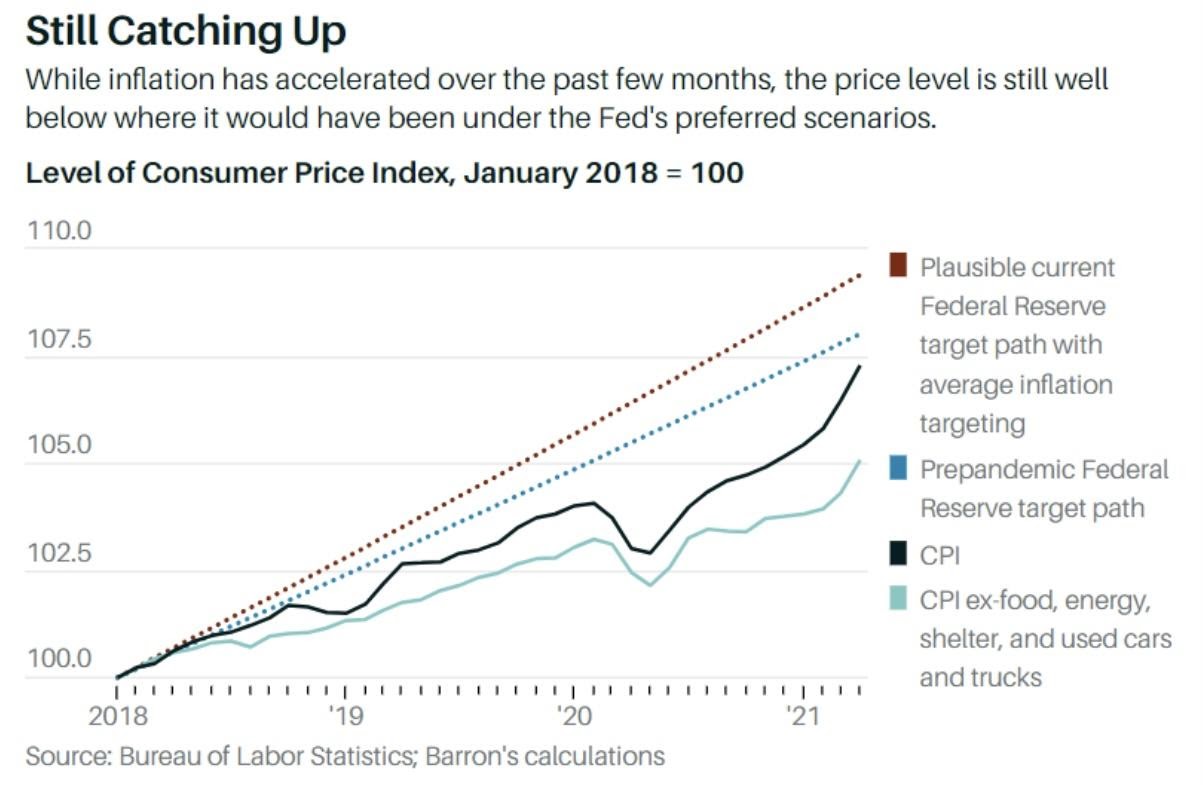

The Long View of Inflation

As many are fearful of a return to the ‘70s and ‘80s style inflationary environment, it becomes essential to review post mortems of that era, especially by Allan H. Meltzer, a monetary policy expert, economist and a scholar. He has written prolifically about the Federal Reserve and states in his important work, titled “The Great Inflation,” that there was a widely held belief in both the Fed membership ranks as well as the executive branch that monetary and fiscal policy had to be coordinated. There was a desire to achieve 4% unemployment with lofty productivity targets that were once achieved in the ‘50s after the wars.

Even Fed Chairman William McChesney Martin, Jr., considered a symbol of conservative monetary policy, could not adequately highlight the need for higher rates during the ‘60s, while Chairman Arthur Burns routinely and publicly faced pressure from the Nixon administration for a gradualist approach.

The policy of disinflation is socially costly and thus, nearly 50 years later, we are experiencing the same splits between “accommodation till full employment” and “money supply should mirror GDP growth.” Treasury Secretary Janet Yellen has been driving the budget neutral focus on most of the future pending priorities, especially around Infrastructure. If this remains true, albeit at the cost of some tax increases, it should sustain the money supply at these elevated levels but not add to it.

At this point, we have experienced just one month’s worth of data highlighting price elasticity. Construction and permits in new residential homes pulled back last month as did a whole host of commodity prices including lumber, down nearly 25% from its highs (see image below). To fear continued high inflation beyond supply shocks, one must anticipate sustained demand at these prices. These recent data suggest otherwise.

Looking Ahead

There are clear signs that a just-in-time supply chain does not go well with a pandemic-induced shutdown. What is being under-appreciated is that there is little evidence of overwhelming demand that persists at any price curve; or the sort of demand that feeds on its own with delayed gratification going out the window. Third quarter inflation readings will shed further light into these dynamics.

Even though elevated inflation has joined the party uninvited, it has not crowded out the room for wage growth and corporate profits so far. As supply chain constraints self-alleviate through inventory building, so should the unwelcome flashbacks of the Great Inflation.

The opinions presented are subject to change without notice in reaction to shifting market conditions. Information provided is believed to be accurate as of the date of original publication and some data was obtained from third party sources. Although these sources are widely used, and Carnegie deems these sources reliable, Carnegie makes no guarantee as to the accuracy of the information provided by these third parties. Past performance is not a guarantee of future results.

Need a Financial Advisor?

If you are currently looking for help with financial planning, contact us. We are happy to schedule an introductory meeting at your convenience.