We learned a lot about ourselves in 2020. Below are some "Do's and Don'ts" we should keep in mind for the coming year:

Don't Let Your Political Opinions Influence Your Investment Decisions

The scene at Capitol Hill two weeks ago was alarming, but the stock market rose over one percent that day. Investors have been worried about the market crashing if a "blue wave" occurred or if Trump/Biden won the election. Once we knew what the results were, markets exhaled. The stock market does not care about one's political opinion. Josh Brown recently said: "It's the end of the world and my stocks feel fine."

Do Stay Invested

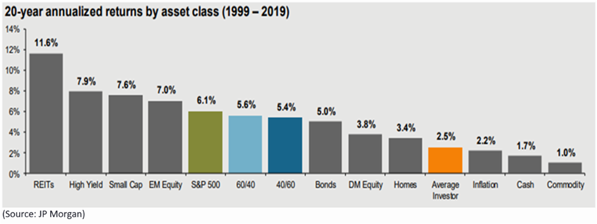

According to Eddy Elfenbein, the S&P 500 gained 17.6% from March 24th-March 26th. For the rest of 2020, it was down 1.1%. March was a concerning time in the markets, but it is difficult to keep up with the market if you do not stay invested during both market declines and rallies. The below chart shows the annual returns of different assets classes over twenty years:

Notice the return of the average investor (orange bar) is only 2.5%, barely above the 1.7% return of cash? The returns of the S&P 500 (green bar) and bonds were better. This underperformance likely reflects portfolio managers and investors who sell during market declines, "wait for the dust to settle," and miss out during subsequent market recoveries.

Do Delegate

The best CEOs, coaches, and clients all have one common trait: they delegate work to those they trust and know can do better than them. Obviously, you have to find people to trust first but once you do, let them do their work.

My dad is an auto mechanic, and he has a rule: he does not fix cars for people who cannot delegate and are a pain to work with. He believes that if they are continually looking over his shoulder, he will not be able to do his best work (my dad is 74 and has been fixing cars since he was 16). I like to think I can do my own taxes, but the amount of time it would take me to, coupled with the fact that I do not trust myself to do the best job, are the reasons why I work with a CPA.

Time is one asset everyone has, and money can buy you more time. Think about how you spend your time.

Do Expect Volatility

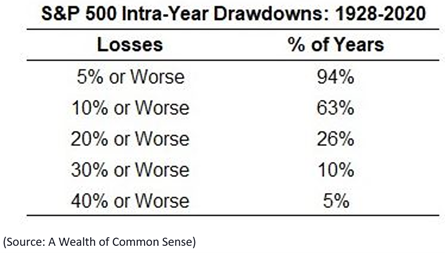

The stock market will be volatile whether you like it or not. How one reacts to it has a significant impact on long-term returns. The below chart shows the frequency and magnitudes of drawdowns in the market:

This chart also makes a compelling argument about why one should buy after major stock market declines as declines of 30% or more are rare and have happened in only 10% of years over a 92-year period. As Barry Ritholtz said: "Market volatility is a feature, not a bug of the market."

Don't Time the Market

If I told you a year ago that we would have the following happen in 2020: a global pandemic, the second-worst quarterly drop in GDP, unemployment not seen since the Great Depression, a controversial Presidential election, and social unrest, would you have guessed that the stock market would be at an all-time high today? Probably not. Even if you invested at the worst entry points, you still had good long-term results if you stayed invested.

Don't Compare Your Returns

The amount of whining from investors and portfolio managers on Twitter is greater than ever. This reaction is because the returns in the stock market were bifurcated in 2020, as illustrated in the chart below:

Growth stocks were up over 33%, while value stocks rose only 1%. Bitcoin gained over 290%, while international stocks were up about 8%. 2020 was not a year where a "rising tide lifted all boats," and investors had different experiences based upon how they were invested. Keep an open mind and focus on your process, not outcomes. The rest is mostly noise.

Looking for a Financial Advisor?

If you are currently looking for help with financial planning, contact us. We are happy to schedule an introductory meeting at your convenience.

The opinions presented are subject to change without notice in reaction to shifting market conditions. Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance does not guarantee future results. An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. The information herein was obtained from various sources. Although Carnegie deems the information to be reliable as of the date indicated, Carnegie does not guarantee the accuracy or completeness of such information provided by third parties.