Market Weakness

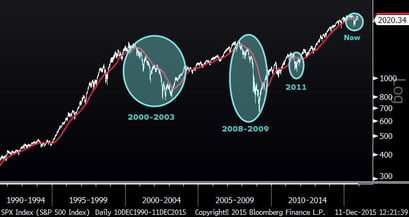

Since August, with the exception of a six-week period that ended earlier this week, the S&P has been trading below its negatively sloped 200-day moving average for the first time since 2011. The 200-day moving average is a widely used method to define whether an index is in a downtrend or uptrend. With this in mind, it would be easy to argue that the market has begun a downtrend. Over the last 25 years, the market has performed poorly when below a negatively sloped 200-day moving average and vice versa. Since 1990, the S&P has increased almost 1000%. Within that span, Investing only during periods when the S&P was below a downward sloping 200-day moving average would have resulted in a 75% LOSS of capital. Currently, the market has just barely ticked into this territory, so it is quite possible that a “whipsaw” like 2011 occurs, but it is worth acknowledging this development. MORE: Are Stocks Headed For A Bear Market?

Periods of S&P 500 below Negatively Sloped 200-day MA

Market Trivia

It has been 27 days since the S&P 500 has experienced two up days in a row. According to CNBC, this is the second longest time-frame since 1970 without back-to-back up days.Quote of the Day

I have not shared a quote for a long time, but I collected a few for a recent presentation. So, related to the commentary above, here is an old stock market adage… “The Trend is Your Friend.”

High Yield Bonds

A well-known and high profile bond mutual fund manager made an unusual announcement that they will be blocking their investors from withdrawing funds from one of their funds. Some people do not realize this, but many funds have a provision where they can delay redemptions under certain conditions. They said that they are winding down the fund because they do not have the cash to meet redemptions and that many of the bonds they hold are too hard to sell. This a perfect example of the additional risks inherent in bond funds versus holding individual fixed income issues. The amount of money that people are holding in bond funds as their “safe” investments is staggering. The chart below shows the price of the bond fund that is closing. Note that it has been in the condition referred to above since 2014. More on Third Avenue Fund Closure

Third Avenue Focused Credit Fund(since 2009)

Oil

No market commentary today can be complete without acknowledging oil. Oil prices are now at new lows, trading in the $35s. Most of the stocks are not at new lows today, although sme groups within the space have been obliterated lately.

Oil (5 Years)

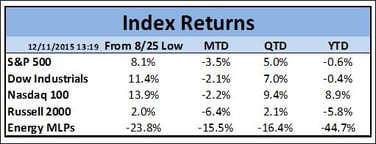

Index Returns