Survey Results

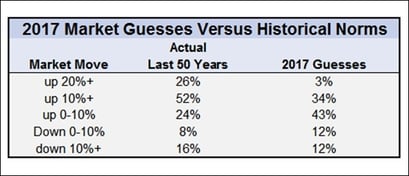

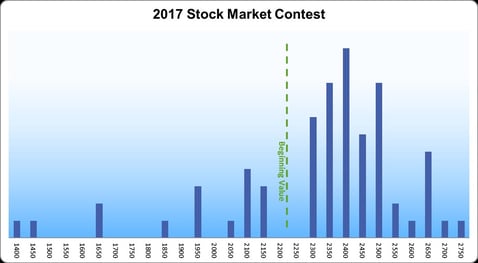

The anxiously awaited results of the 2017 stock market survey are in! The good news is that the blog readers appear to be equally as smart as the leading Wall Street strategists, who are rewarded with seven or eight figure salaries. The bad news is that the blog readers are stuck with the same guess as the strategists, who are very frequently wrong. The median guess of my readers was 2401 -- the most common guess of the ten superstar Wall Street Analysts was 2400, so we hit that right on the mark. Below, is a histogram of the guesses. As you can see, there were very few “flat” responses, lots of “up a little” responses, and a smattering of “down” guesses. In the table below, looking at history, it becomes evident that market returns do not occur in a normal distribution, although the guesses would suggest people think that they do. In fact, the seemingly safe bet of “up 0% to 10%” only has occurred about 1/4th of the time over the past 50 years, but almost half of the respondents (and Wall Street) guessed in this range. Historically speaking, “down” and “up 20%+” are just as common as “up 0-10%”. Given those two options, which would you choose?

The “Enernet”

The cost of solar energy has plummeted 60 percent since 2009 and is expected to drop another 40-60% by 2025 (only eight years away). Many are projecting that solar power will be the cheapest form of power within the next ten years, and new solar projects are popping up every day – you have probably noticed more solar panels just driving around in your car. In some parts of the world, solar is already cheaper than coal and many innovative and progressive companies are already using solar power as their primary source of energy. The plummeting costs of solar energy along with advancements in technology are converging to create what some are calling the “enernet”, which has many similarities to where we were with the Internet 25 years ago. LEARN MORE: Energy is the New Internet

Jobless Claims

Usually, when I look at continuing jobless claims, it tells me the same story – that they are still going down. And although the labor markets in general appear to be very strong, the last few readings in continuing jobless claims have been trending upward, however. This coming from a low base, and is very short-term, so it is not necessarily an indicator of a new and rising trend. Additionally, there are many other reasons for this to potentially be dismissed. That said, most bigger and longer-term trends start with a short-term trend, so if nothing else, this data set is worth keeping on the radar screen since I have not mentioned it in a while.

Continuing Jobless Claims (Three Years)

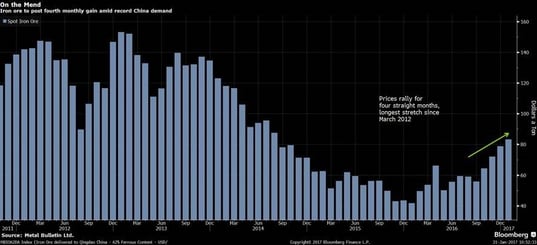

Iron Ore

Iron ore prices have experienced their longest rally in five years and have doubled since the low a year ago. Apparently, there has been record demand from China as a result of their economic policies and infrastructure initiatives. It is no surprise that iron ore related stocks have moved up significantly during this time, as well. MORE: Iron Ore's Destiny May Turn On Supply From China's Own Mines

International Versus U.S. Stocks

The chart below shows U.S. stocks versus international stocks over the past decade. As you can see, they have typically moved together, but U.S. stocks have diverged from foreign stocks over the past three years. For those who believe in reversion to the mean, this would suggest that foreign stocks might look attractive compared to their U.S. counterparts. What do you think?

U.S. Versus International Stocks (Ten Years)