Restaurants are the New Retail

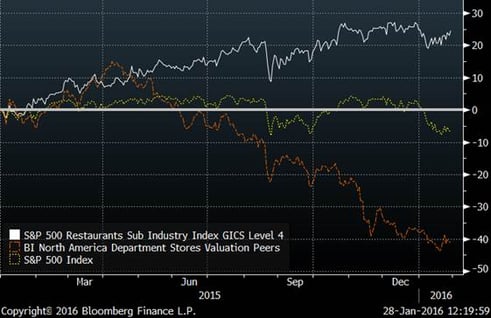

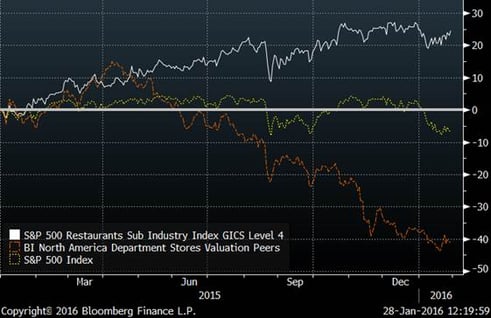

I can’t speak for other cities, but in Cleveland there has been an influx of new and great It occurs to me that restaurants are becoming the new retail. In the past, people would go shopping at the mall and much of the fun was about the experience of going to the mall, not necessarily about buying things. Now, people are making more purchases online and malls seem to be dying. Instead of going to the mall, however, people are spending their free time on culinary experiences. People are thinking of going out to eat as more of a social experience than just a way to fill their stomachs. As you can see below, restaurant sales now exceed grocery store sales for the first time ever. The bottom chart shows that over the past year, restaurant stocks have significantly outperformed the market, while department stores have significantly underperformed. Is this a short-term coincidence or a reflection of a long-term trend shifting from traditional retail and toward culinary experiences? Related: Celebrity Chefs Feed Cleveland Real Estate

Restaurants Vs. Retail

Oil and Market Correlation

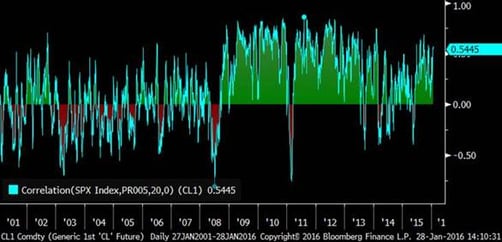

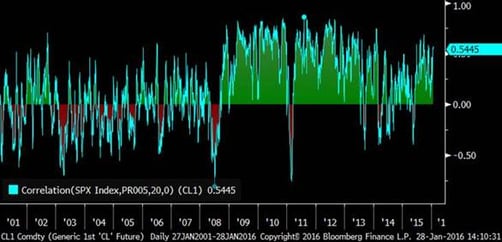

The media has recently latched on to the idea that oil and the market are suddenly highly correlated. It is true that they are highly correlated, but it is not a new phenomenon. In fact, for the most part, they have been highly correlated since 2009. The chart below shows the correlation of oil prices and the S&P 500 since 2001; green represents positive correlation and red represents negative correlation. More: What Drives Crude Oil Prices?

Oil and S&P 500 Correlation (15 years)

Sector Returns

As you certainly know, January has been one of the worst Januarys on record for the stock market. Not surprising, there have been few places to hide during the market selloff. Interestingly, as much as energy stocks have been the focus in the media, the group is actually down less than the market so far this year.