Last night when I went to bed, my clock radio only had 18% battery left, so I was worried that it might not have enough juice to make it through the night. This made me think…if back in 1985 you had told someone that a single company would be the market leader in all of the following consumer goods markets, what would you have said?:

- Flashlights

- Telephones

- Cameras

- Video Cameras

- Tape Recorders

- Calendars

- Alarm Clocks

- Clock Radios

- Clocks in general

- Calculators

- Maps

- Phonebooks

- Rolodexes

- Appointment Books

- Answering Machines

- Stereos

- Portable Music Players

- Thermometers

- VCRs

- Televisions

This is just a partial list of tangible items that we no longer need and use Apple products (or others) as a better solution. This list of tangible items that are now obsolete merely scratches the surface. Our devices (along with the internet, which they give us access to) have eliminated the need to go to the mall, call a travel agent, go to the library, buy encyclopedias, call a taxi, go to the bank, and even in some cases to even go to school. Heck, people even fall in love via these incredible devices. Ironically, our cell “phones” have even eliminated the need to make a phone call in the first place. Anyhow, sometimes people question why Apple is the largest company (by capitalization) in the world. If someone had told you in 1985 that a single company would lead the market in so many verticals, you would have been easily convinced that it is the largest company in the world. So why, now, should we be surprised that the leader in such a transformative technology is bigger than the mighty Exxon Mobil or General Electric?

Goldman Says Economy Still Has Legs

The U.S. economy has now been in expansion mode for 76 straight months – the fifth longest period since 1900. So far, the economy has defied predictions and has avoided several threats that analysts and the media claimed would de-rail the economy. Today, Goldman Sachs came out with a “glass half full” prediction (actually 60% full) and predicted that there is a 60% chance that the U.S. economic expansion will live to see its tenth birthday. This was considered good news, but I wonder if people would have been so happy if the headline said that there is a forty percent chance of recession within the next four years?

Gold

Gold has faded as a major topic over the past couple of years. I have not brought it up in a long time, so I figured I would take a look. The chart below shows the strong uptrend from 2001 through 2011 and the subsequent downtrend it has experienced over the past four years or so. Not surprisingly, since Gold usuallymoves opposite the U.S. Dollar, the Dollar has been trending upward since the 2011 peak in Gold.

Gold (Since 2001)

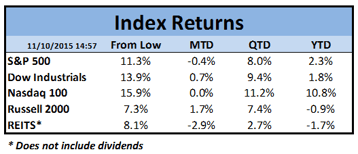

Market Data

I added REITS to the mix today to show that they have been weak lately. With an impending rise in interest rates, most dividend paying groups have been punished. The REIT index does not include dividends, so the total return would be about 4% higher on an annualized basis.