Rental Market

We all know that urban rental markets across the country have been very strong, and Cleveland is no exception. I have been told that about 2,000 people are on waiting lists in downtown Cleveland alone. As anyone who knows me is aware, my son and I like to tour old buildings, so last week we were thrilled to go on a tour of several new housing/office projects taking place in Cleveland. It is amazing how much residential space has come online in the last few years and even more remarkable how much is planned and under construction. RELATED: Cleveland Apartments Rising at Insane Rate

On our tour, we had a behind-the-scenes look at four new projects, only one of which was finished. The unit we toured in the finished project was being rented out as an AirBnb. The second project was a relatively small apartment building; the owners were a group of basketball players from a different city who had invested in this building and were rehabbing it. The third project was a repurposing of a large warehouse space into residential. The owner told me that this project had never been viable until now and that this was the first project of this kind that they had done. The last project was a huge 21-story former office building built in 1925. Again the owner of this building told me that they usually do commercial work and that this was their first venture into residential.

My observation here is that all of these buildings are being done by new entrants into the market. As excited as I am to see all this new construction and to see my city grow, I cannot help but wonder if we are starting to get into “bubble” territory. It is often a sign of a bubble when there are new unexperienced speculators entering the market. Apparently, Cleveland is still near 100% occupancy, but with multiple huge projects coming online in the next couple of years, it will be interesting to see if we can sustain this growth. WATCH: Rental Prices Showing Signs of Decline

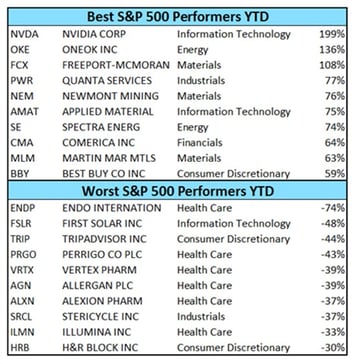

Best and Worst of 2016

The table below that I made shows the best and worst performing stocks in the S&P 500 for 2016. As bad as healthcare stocks have been this year, it is not surprising to see so many of those on the “worst” list. The top ten list is a bit more diverse, although I am a bit surprised to see three materials stocks on this list. Any student of the market will not be surprised to see NVDA at the top of this list – in fact, it is the only stock that was also on the 2015 list. Please submit your guess for the top performing S&P 500 stock of 2017. If you can guess this correctly, you will receive an awesome prize!

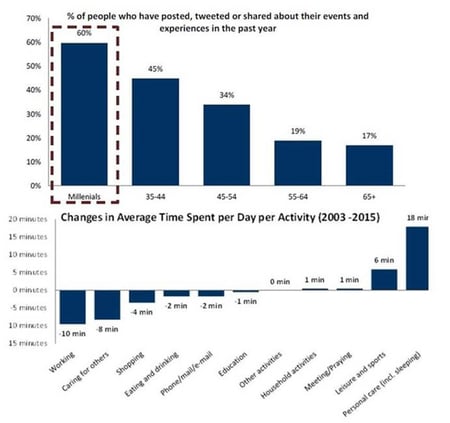

Behavioral Changes

Carnegie’s own Raz Pounardjian forwarded the chart below from RBC Capital Markets. It is not surprising to see the correlation between age and sharing experiences. In the bottom chart, it is interesting to see a decrease in work and an increase in leisure and sports, which supports the premise that people are more into experiences now than “stuff”. Also of interest is the noticable rise in personal care and sleep. Apparently, the growth in Snapchat and other selfie-based social media apps have created strong demand for makeup, with makeup sales growing in the double digits. One company that has benefited from this trend is Ulta Salon Cosmetics, whose stock is up 3x since 2014. Who would have thoght that technological advancements in iPhones and their apps would have driven sales in the makeup industry? MORE: Selfie Culture is Driving Makeup Sales

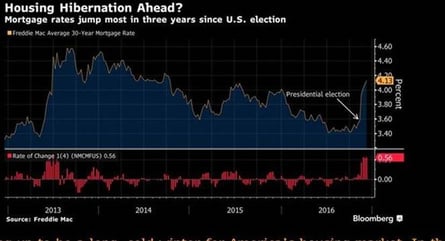

Mortgage Rates

The chart below illuminates the rapid increase in mortgage rates since the election. While still historically low, the move up has been strong and swift. There are some who worry that this move and potential subsequent increases in interest rates could negatively affect the housing market. Related: How Rising Mortgage Rates May not Matter for Housing