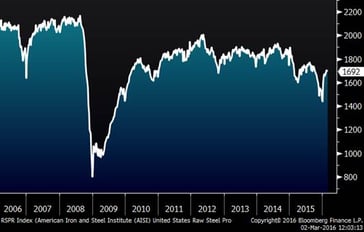

U.S. Steel Production

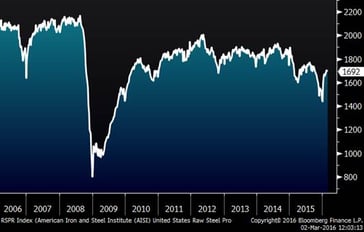

U.S. steel production has jumped this year. In talking to some of my contacts in the steel industry, the comments range from “things are still dismal” to “there is a ray of hope” to “there are pockets of strength and weakness, depending on which type of steel you are talking about.” While the recent bounce back is nice, the chart below illuminates the fact that steel production in the U.S. is still trending down and is still far below 2008 levels (before the bottom fell out). Not coincidentally, as you can see in the second chart, steel stocks have bounced over 50% from their recent lows. MORE: U.S. Steel Imports Drop Sharply in January

U.S. Steel Production

Steel Stocks (Six Months)

Beauty and the Beast

The market has been a bit like “Beauty and the Beast,” with some defensive sectors behaving beautifully while others have been beastly. Speaking of “Beauty and the Beast”, historians had previously believed that most fairy tales dated back to the 16th and 17th Astonishingly, new research shows that many common fairy tales, including “Jack and the Beanstalk” and “Beauty and the Beast”, can be traced back 4,000 to 5,000 years, which pre-dates the earliest literary records. READ MORE: Fairy Tale Origins Thousands of Years Old

Market Sentiment

In the January 21 Carnegie Market Blog, I mentioned that the market bullishness had fallen to the lowest level in over a decade, including the “Great Recession” 2008-2009. Sure enough, since this and another low reading in February, the S&P 500 has bounced almost 10% and is roughly half way back to its all-time high of 2134 set last May. The next AAII sentiment reading will not be released until tomorrow morning, but it almost certainly will be back to “normal” levels. The extreme negative sentiment was obviously followed by a strong bounce in the market, but the bigger question market participants are debating is whether it was “THE bottom” or just a “dead cat bounce”…time will tell.

Index Returns

The table below is sorted by the return since the recent market low. As one might expect, the worst performing sectors during the market rally have been the most defensive: utilities, staples and telecom. Looking back further, these three sectors are still the best performing S&P sectors in the weak market experienced over the past year.