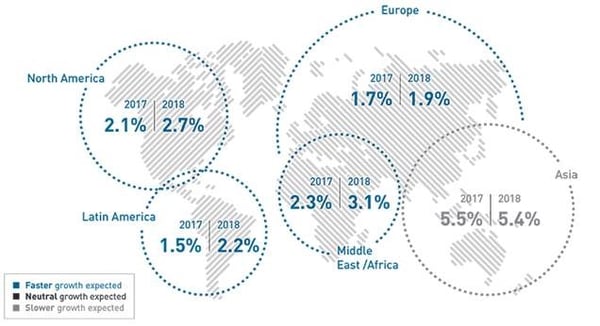

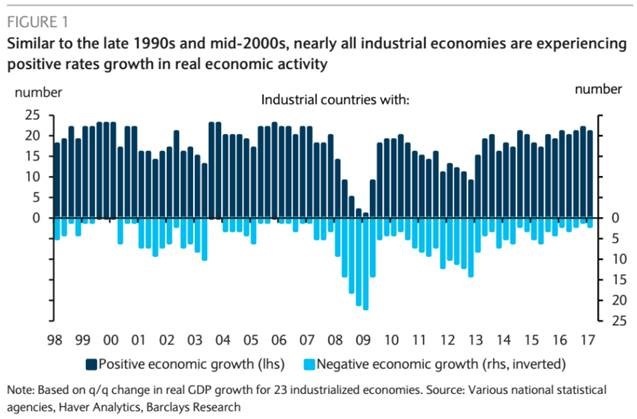

Synchronized Global Growth

You may have noticed that stock market indices around the world have all been moving higher over the past year or two. It was not very long ago that investors were panicking over “Brexit” and the European economy in general. As you can see below, and as the stock markets imply, we are seeing synchronized global growth like we have not seen since before the Great Recession. Many believe that this reflects the fact that world is finally past the destruction caused during that period. In the last blog, I discussed the fact that 2017 has been one of the least volatile years on record and that periods like this can encourage complacence. The charts below remind me of the same phenomenon – it is important to remain diligent when everyone else is comfortable and complacent. MORE: R.I.P. Bears

Dow Notches Eighth Straight Positive Quarter

In the past year, the U.S. has experienced major hurricanes, unprecedented political division, nuclear threats from North Korea and now the deadliest mass shooting in our country’s history. So, it should come as no surprise that the Dow Jones Industrial Average just notched its eighth straight positive quarter for the first time in twenty years, right? Below is a 100-year chart of the Dow – looking at it this way, even 2008 didn’t seem that bad…right? RELATED: Buffett -- Dow Will Hit 1 Million in 100 Years

Dow Jones Industrial Average (100 Years)

Cleveland Indians

If you have not noticed, the theme of today’s blog so far is exuberance. Whether the markets are in a state of “irrational exuberance”, as Greenspan coined, I will leave up to you to decide. Speaking of exuberance, I just finished reading a story in a major New York publication that the Yankees have no chance against the Indians. For the first time in my memory, the national media has a Cleveland team as the heavy favorite to “win it all”. Just like the market exuberance, it makes me wonder if I should be concerned. In any event, I am taking my mom to the game tonight for her birthday – she has never been to an Indians game at the new stadium (it was new in 1994), so GO TRIBE!

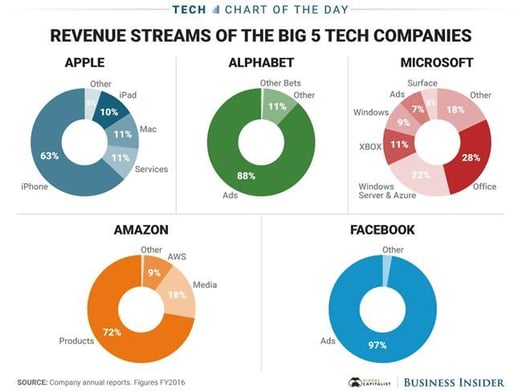

Big Tech Revenues

No Carnegie Market Blog is complete without a mention of technology, so here you go! I came across this chart last night and thought it was interesting:

Have a great day!