Amazing Cement Statistic

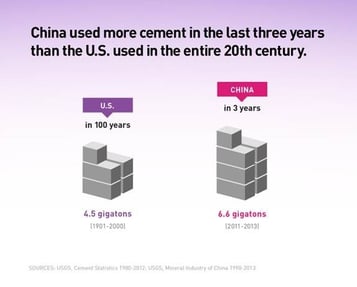

This is a bit old, but I just read about how China used more cement in three years than the U.S. used in the entire 20th century. Cement is one of the most important substances in human history and its usage is a perfect indicator for growth and construction. The fact that China used that much cement is a testament to the explosive growth they experienced. The alleged “fake cities” they built probably did not hurt this growth either. Related: U.S. Will be Bright Spot for Cement Demand in 2017

Minitaur

Many of us think of robots as either something that looks like a human or something that assembles things at a factory. Check out “Minitaur”, a recent example of what robots can now do by using artificial intelligence. Imagine what robots will be like in ten years! Watch Minitaur in Action

Bond and Stock Yields

The chart below shows the dividend yield of the S&P 500 versus the 10-year U.S. Treasury rate. The past decade has seen the first times in generations where investors were paid more in dividends to hold the S&P 500 than they were paid to hold U.S. Treasuries. Most would argue that this was an unusual circumstance and in all three episodes (so far), investors were rewarded by investing in stocks versus bonds. After the election, as stocks and rates rose, this relationship moved back in to the normal condition of interest rates being higher than stock yields. With many expecting higher rates (some are expecting lower dividend yields too), will they ever invert again? Related: Stocks and Bonds are at War over Trump Growth