Big Data Factoid

As we know, the amount of data we are creating is growing exponentially. It is estimated that as much data has been created in the past two years than in the entire history of mankind before that. What you probably did not know, is that only 10% of that information is publicly accessible. According to IBM, 90% of data resides behind firewalls, just waiting to be accessed and analyzed by advanced technologies to create new insights. MORE: IBM Wants to Bring Machine Learning to the Mainframe

Target and Domino’s

This week, as Target missed expectations, it became painfully obvious that trends are not in their favor. On the other side of the coin, Domino’s Pizza, which was a struggling, old-fashioned pizza chain has been booming. It is, in fact, one of a select few stocks that has been beaten the S&P 500 for five years straight. It strikes me that both of these companies, like almost every company, are being affected by broader trends driven by technological change. In Target’s case, they have been decimated by e-commerce. They are no longer the most convenient and low-cost seller of their goods, they have been slow to adapt and the Target customer experience has deteriorated.

Seven years ago, Domino’s found themselves in a similar quandary. They had a mediocre product (at best), they no longer were more convenient than the competition and the customer experience had suffered. Today, they think of themselves as much a technology company as a pizza company and I read that 60% of their orders are now coming in electronically. At the core, this change was about being customer-focused, and management realized that in today’s day and age, technology is a tremendous driver of the customer experience. Instead of trying to enhance the customer experience through traditional methodologies, the company changed course through the adoption of technology – they started this seven years ago, long before many others had thought of it. Every day, there are more and more cases of seemingly “old-economy” businesses reinventing themselves with technology. Is your company using technology to truly improve the customer experience or are you asleep at the wheel? Read More: How Domino's Disrupted the Delivery Game

Target vs. Domino’s (10 months)

Best of Times for Credit in the U.S.

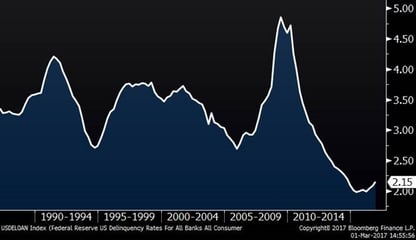

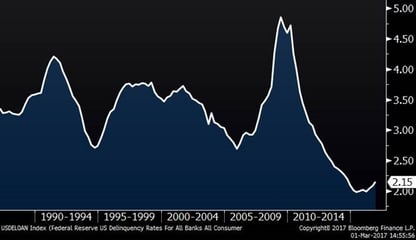

At the JP Morgan Investor Day yesterday, CEO Jamie Dimon said that credit in the U.S. has “never been better, ever, ever, ever, ever, ever, ever, ever, ever, ever, ever, ever, ever, ever.” He literally pounded the table with each “ever” and followed up by saying that it never will get better from here either. Interestingly, he said that big data is one of the reasons for this. The chart below shows consumer loan delinquency rates over the past 30 years. It is amazing how much this series has changed since the recession. READ: Fired Up Jamie Dimon Addresses Investor Day Related: How JP Morgan is Automating High Finance with A.I.

Consumer Loan Delinquency Rate (30 Years)

Lumber Costs

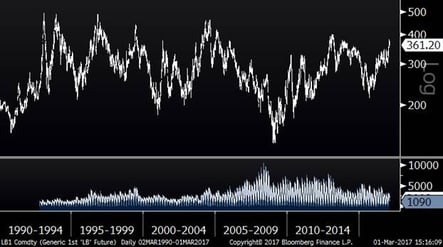

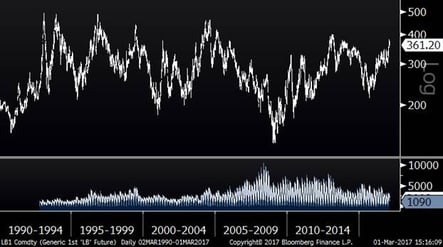

There has been talk lately about the recent spike in lumber costs and that it suggests a major pickup in homebuilding. The chart below illuminates, however, that the recent move is not atypical of this highly cyclical and volatile commodity. If anything, I am surprised that given inflation, it is in the same range as it was 25 years ago.

Lumber Prices (Since 1990)