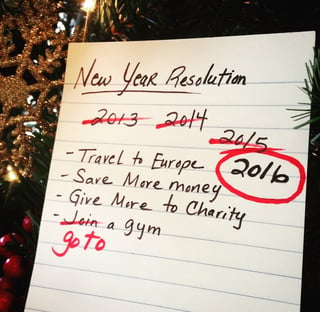

As the calendar turns, we look towards the New Year with optimism on what can be accomplished over the next twelve months. Not in terms of performance, as 2015 reminded us, much of that is out of our control. We can construct solid portfolios, but the market will deliver what it will. What is in your control is the action you take this year that you didn’t take last year to improve yourself. This is often called your New Year’s resolutions, typically a list hastily compiled and often dismissed by Martin Luther King Day. This year we’d like to suggest making one resolution in 2016 that will improve either your life or the life of someone else you love.

Save More

Saving more money can be a resolution; however, it won’t happen without stating a number or percentage. If you were able to save $1,000/month last year, a resolution of $1,100/month would be a 10% increase in savings and will have a significant impact on your future portfolio. It can also be stated as percentage; if you saved 5% of your after-tax earnings, increasing this to 7% could be your resolution. If you are not sure you can make that change, do it in steps by increasing the number to 6% now and in six months adjusting it to 7%.

Travel More

Traveling more is an often stated goal of many clients. A great resolution that can quickly go unheeded due to circumstances. Plan one trip and make it happen. There is no time like the present since you have the funds. Decide your destination and then who you want to enjoy the trip with you. Many clients have reached the age where traveling is not an option due to health issues; learn from them and take advantage of your opportunity now. A trip doesn’t have to be extravagant, it could be visiting children, or siblings, just make plans now.

Live Healthier

Resolutions to exercise more or lose weight are wonderful; they simply need to be quantified. If you have no current exercise regime, begin modestly and realistically. If you don’t walk now, consider a fit-bit or an app for your phone that will measure your distance. Start by walking a mile a day and increase the distance over time if you can. We have clients that can run five miles a day, every day without breaking a sweat. They are self-motivated and driven, but they started somewhere and they all measure the distance they travel.

Live Debt Free

Being in debt is not an issue for any of our clients. It is a great lesson to learn, the correlation of living within your means and having money to invest. Debt is a self-inflicted burden that our clients have successfully avoided. However, we all know people with debt and understand the burden it can be, so a resolution can be to assist someone who is burdened with debt via a one-time gift. The resolution can be for education, healthcare, a non-profit or any interest that is important to you.

My 2016 Resolution

Every client meeting is an educational process that goes both ways. I learn more about the client whether it is their concerns or interests and, hopefully, they learn a little more about the current markets and our management with each meeting. My resolution is to increase the number of meetings with clients in 2016. In 2015, I had 133 client meetings, or nearly eleven meetings per month. My resolution is to spend more time with clients and have twelve client meetings every month, what is your resolution?